- The Director's Special

- Posts

- MinRes Cuts while Liontown Pleads for Relief

MinRes Cuts while Liontown Pleads for Relief

Woodside gets whacked after M&A, ERA lawyers get busy

The Pre-Start

ERA has commenced legal proceedings in light of the NT government’s recent decision to not renew the Jabiluka mineral lease (ERA)

Catalyst released an updated resource at K2 and Plutonic East of 81koz at 3.6g/t Au and 182koz at 2.5g/t Au respectively (CYL)

The Aussie Retirement Trust picked up 5.1% of Boss Energy (BOE)

Yarra has become a substantial shareholder in Cooper Energy with a 5.1% stake (COE)

Horizon Minerals executed a JV with BML Ventures to mine and develop two open pits and Phillips Find, to be processed under its toll milling agreement with FMR (HRZ)

Westgold commenced trading on the TSX following its merger with Karora (WGX)

Arizona Lithium produce lithium carbonate via its DLE pilot plant, with the first commercial production well now drilled (AZL)

High Grade It

Mineral Resources will reportedly shed 100 white-collar jobs from its Perth headquarters due to the Yilgarn hub shutdown (BN)

Liontown Resources boss Tony Ottaviano has put his hand up for government assistance, pleading for royalty relief (AFR)

Woodside had almost $2.6b wiped off its market value after it was dealt a harsh investor reception to its surprise $3.7b ammonia purchase (AFR)

Newmont are in Federal Court to dispute a $133m tax claim dating back to 2011 restructure (The Australian)

Pilbara hasn’t ruled out diversifying into other commodities, but Dale Henderson said he doesn’t see it stepping outside lithium soon (BN)

Gold steadied after being pulled into Monday’s global rout (Bloomberg)

‘Too big to fail’ lithium to remain crucial amid market uncertainties, says IGO’s Vella (MW)

The faltering nickel sector should jolt the iron ore industry out of its complacency, according to FMG boss Dino Otranto (AFR)

Industrial metals found firmer footing on Tuesday, the day after commodities were swept up in a tumultuous global selloff (Bloomberg)

The WA state government will take tighter control of the Perth Mint, bringing its operator Gold Corporation further in-house (BN)

China’s flood of steel exports could ease in coming months, as trade partners seek to protect their domestic industries (Bloomberg)

Glencore’s corruption probe drew to a close with a US$152m swiss fine (Bloomberg)

Liontown boss Tony Ottaviano hit out at short sellers targeting his stock (The Australian)

Not the first time this has been said by a producer in ramp up before…

Wheelin’ n Dealin’

Mayur Resources updated on ACAM’s proposed US$50m investment, with an additional 8-week DD period provided (MRL)

Australian Meat Industry Super are up to a 34% stake in Dynamic D&B as part of their on-market takeover (DDB)

Yancoal hires RBC in its quest to buy Anglo American’s Queensland met coal mines, expected to sell for up to US$5b (DataRoom)

OAR Resources signed an MoU with Indústrias Nucleares do Brasil to work on developing of OAR’s rare earth and uranium projects (OAR)

Between the gossip we’ve been hearing at the pubs in Diggers and today’s article in DataRoom, the Gold Road M&A speculation continues to run rife

Bridget Carter reckons any discussions that may have been taking place between Gold Road and Regis are understood to have ended, but there are suggestions that Emerald and Capricorn have both run the ruler over Gold Road as well

Gold Fields has made it clear it isn’t a seller of its Gruyere operational rights and is committed to the Aussie market

A Money Miner reminded us of the details of the standstill arrangement Gold Road agreed with Goldfields back in 2017 when it increased its HeadCo holding to 10%

Our read of the terms is Goldfields can’t bid for Gold Road until:

a) It’s 2 years after they cease to be part of the Gruyere JV (unlikely)

b) Someone other than Goldfields bids for Gold Road, they could interlope (likely)

c) When the Gold Road board announces an approved deal, they could interlope (also likely)

This makes structuring any prospective deal with Gold Road quite interesting. Could we see Gold Road act as the “acquirer” with no fiduciary out in an attempt to avoid a deal being frustrated by Goldfields?

And who would run this prospective MergeCo? Given Gold Road essentially operates as an expensive royalty company, it makes sense to have an actual operator at the helm…

And on that note, the Money of Mine team are heading home after a long week at Diggers. That’s enough yarns, beers and 2am kebabs for now, until next time!

Rattlin’ the Tin

Altech launched a $8.5m entitlement offer (partially underwritten), as well as a small $0.4m placement (ATC)

Word on the Decline

Not sure if you caught the comments from Lynas boss, Amanda Lacaze in the press yesterday:

With an election on the horizon, Ms Lacaze said uninterruptable power, and plenty of it, at low prices was at the top of her wish list. Lynas was hit by the major electricity outage in late January which left Goldfields businesses and residents without power for days.

“For us to be able to do more with the facility that we have already built here, we need power, and we need low cost power,” she said.

Those comments came after Kim Beazley called for national stockpiling of rare earths…

Word on the Decline is that when Peter Dutton left the Diggers & Dealers conference, he went to a meeting with the Shire council to talk turkey on nuclear rollout in Kalgoorlie…

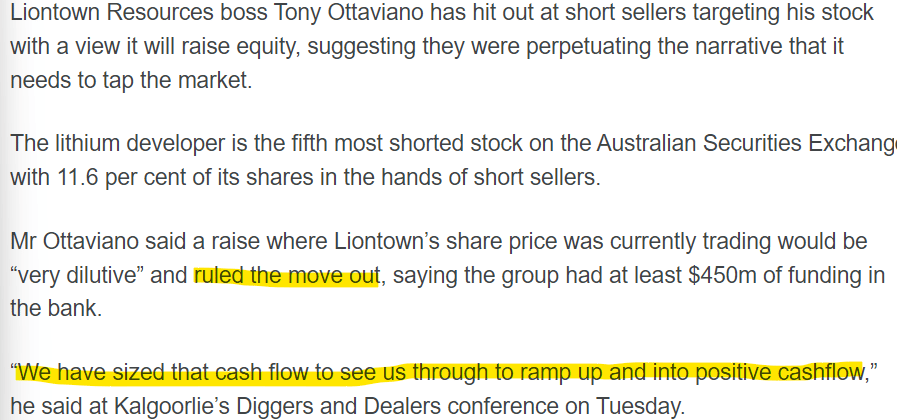

While on the topic of Lynas, we noticed gas coming out from the top of the WGT Stack at their Kalgoorlie facility when driving past yesterday afternoon.

But when we drove into town just two days earlier, we are sure there was just as much gas coming out of the top of the plant as can be seen coming from the World’s Tallest Bin!

They are somewhat similar structures too

We wonder if Lacaze would point to power blackouts as the reason for the disparity. Or maybe it has more to do with the fact that Lynas’ site visit was Monday?

Do you have some Word on the Decline? Reply to this email or shoot a message to [email protected] directly. We will always take your privacy seriously.

In the Weeds

The IEA’s divisive mission to decide the future of oil (FT)

Entering the opaque, alien world of non-exchange-traded commodity offtakes with Allan Trench and John Sykes (MiningNews)

Around a third of carbon credits fail new benchmark test (Reuters)

EV maker Lucid receives further US$1.5b in Saudi funding ahead of SUV launch (FT)

Oil traders that rely on trend-following algorithms have rapidly turned bearish over the past week as equities plunged (Bloomberg)

AI tech transition will mean fewer mining jobs, Gold Industry Group panel forum told (West)

Saudi Aramco to pay out US$124b in dividends this year as it says oil demand underestimated (FT)

Today’s Top Tweet

Devil’s in the Detail

If you dig into Magnetic Resources’ updated study numbers from Monday, we think it’s more than just the capex that is (obviously) undercooked.

The implied BCM rate looks to be under $8/bcm. Compare that with most peers that have put studies out since last year which come in at around $9.5-12/bcm…

Catch up on our latest episode

🟢Spotify | 🟣 Apple Podcasts | 🟥 Youtube

Reply