The Pre-Start

BHP produced 69.2Mt ironore, 505kt copper, 4.9Mt met coal, 3.8mt thermal coal and 23kt nickel over the quarter (BHP) Production and cost guidance met across all commodities

All conditions have been satisfied for Rio’s investment to develop the Simandou iron ore deposit in Guinea (RIO)

Barrick produced 948koz of gold and 43kt of copper in Q2, on track to meet guidance. AISC is expected to be ~2% higher than Q1 (GOLD)

Mt Gibson produced 0.9Mwmt, hitting the high end of guidance & generating $290m over FY24, leaving $436m in cash & reserves (MGX)

Core Lithium holds $88m in cash at the end of FY24, with c. 5kt of spod concentrate and 75kwmt of lithium fines to be sold (CXO)

Aurelia shared exploration results from various programs, with better hits at QueenBee, and the North & South Mines at Peak (AMI)

Blackrock increased its stake in copper developer Firefly to over 13% (FFM)

High Grade It

Gold jumped to a record high after comments from Federal Reserve officials cemented expectations of a U.S. interest rate cut (Reuters)

The U.S. approached Indonesia regarding a multinational partnership to boost the Asian nation's environmental standards (Reuters)

Rio’s iron ore exports inched up, while stating China was supported by a recovery in manufacturing and “more resilient exports” (Bloomberg)

The Ivan Vella-led IGO said on Tuesday that it expected to write down the value of its exploration portfolio by up to $275m (AFR)

BHP posted another record annual iron ore production, helped by improved weather & higher contribution from its South Flank (Reuters)

The world’s biggest copper buyer, China’s State Grid Corp, slowed copper purchases while ramping up aluminium orders (Bloomberg)

Argentina tripled its lithium carbonate equivalent (LCE) production capacity in the last two years (Reuters)

Climate groups called a decision to open the UK’s first deep coal mine in more than 30 years unlawful, with cases going to court (Mining.com)

Battery metal giant Ganfeng plans to build a $1.1b trading desk to hedge against extreme volatility and geopolitical tensions (Bloomberg)

Wheelin’ n Dealin’

Peak Rare Earths received a non-binding term sheet from a consortium of lenders to provide US$176m debt to fund the Ngualla project (PEK)

Kingsgate has entered into definitive loan docs with Nebari for a US$35m term facility to refinance its existing bridge facility, get new equipment & expand reserves (KCN)

Venture Minerals completed the sale of its Riley iron ore mine for $3m (VMS)

Hancock’s share in the Mt Bevan magnetite JV increased from 30% to 51% following the completion of an initial study (AFR)

Rattlin’ the Tin

Montage Gold launched a C$170m raise to advance its Koné gold project in Côte d'Ivoire cornerstoned by Zijin (C$57m for a 9.9% stake) and Lundin Trust (C$49m taking them to 19.9%) (MAU.to)

Assore has made a strategic investment of C$68m into Marimaca Copper, buying Tembo’s C$42m stake and the balance in newly issued shares (MARI.to)

Tesoro Gold is in a trading halt to raise at least $8m to fund exploration and drilling at its El Zorro project (TSO)

Word on the Decline

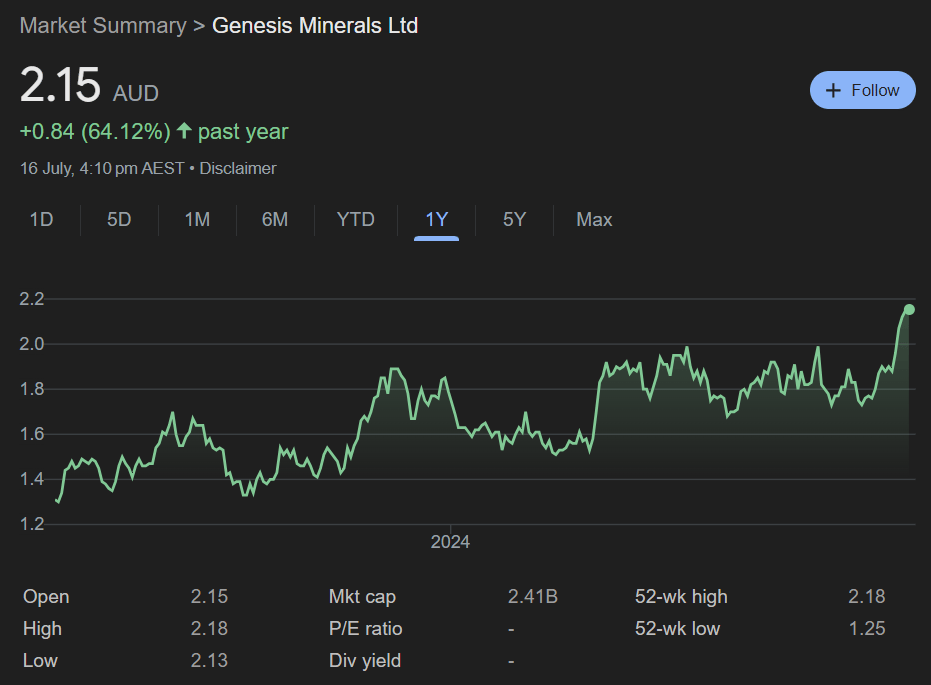

At an all-time high share price, it must be tempting for Genesis to use their scrip for more regional M&A

We know all the external messaging has focused on telling the market it’s all about delivering on the assets they already have

But with a $2.4bn market cap today, they could cough up a 30% premium to Magnetic Resources, pay $400 million in GMD scrip and only dilute shareholders ~14% in the process

In return, they’d get 1.9Moz at 1.8g/t ~15km from their Mt Morgans mill which is one year away from restart

And with Gold Fields active once again in WA, would Genesis be concerned the relatively high-grade dirt could find its way to feeding their under-utilised mill around the corner, instead?

TBA on all fronts, but this possibility is one we are now watching

Do you have some Word on the Decline? Reply to this email or shoot a message to [email protected] directly. We will always take your privacy seriously.

In the Weeds

Resources sector’s No.1 health indicator flashes red (AFR’s Chanticleer)

The head of AMEO has heightened pressure on the Coalition’s energy policy by ruling out nuclear as a solution (The Australian)

Can Xi keep a lid on China’s mounting social strains? (FT’s Big Read)

L1 Capital’s quarterly report is worth a read (L1) Resource sector underperformance is highlighted on p. 2, with goldies discussed on p. 5

Were you forwarded this email from someone else?

Devil’s in the Detail

Did you catch DGR Global’s monster 233% rise yesterday on volume 762x the month’s average?

The confusing microcap holds equity interests in a number of listed companies and until yesterday it traded at a 77% discount to our napkin math calculation of its NAV. The largest holding, SolGold, rose a mere 10% on financing news but that seemed enough to alert the market of this pseudo-LIC’s “value”.

The discount to NAV on DGR has tightened to 24% and it’s anyone’s guess what this number should really be. There’s a few more warts on this vehicle vs the typical investable LIC.

If there’s one clear takeaway from this, it’s that the efficient market hypothesis is a load of shit.

Today’s Top Tweet

Matty’s going back on the Jumbo

Once the go-button is hit on the Antler copper project in Arizona, this has Matty’s name written all over it to cut the portal.

He is proposing a DIDO roster in and out of Las Vegas, a mere 250km away. Please let him know where to send his CV.

Catch up on our latest episode

Wanna plug your business in the Directors Special?

Disclaimer

All information in this newsletter is for education and entertainment purposes only and is of general nature only. The hosts of Money of Mine are not financial professionals. Money of Mine are not aware of your personal financial circumstances. Before making any investment decision, you should consult a licensed financial, legal or tax professional, along with considering any relevant Product Disclosure Statement. Money of Mine does not operate under an Australian financial services licence and relies on the exemption available under the Corporations Act 2001 (Cth) in respect of any information or advice given. Money of Mine strives to ensure the accuracy and currency of the information contained in this newsletter but we do not make any representation or warranty that it is accurate, reliable or up to date. Any views expressed by the hosts of Money of Mine are their opinion only and may contain forward looking statements that may not eventuate. Money of Mine will not accept any liability whatsoever for any direct, indirect, consequential or other loss arising from any use of information in this newsletter.