- The Director's Special

- Posts

- ERA Scores Last Minute Court Win

ERA Scores Last Minute Court Win

NexGen hits Patterson mineralisation, Piedmont bounces on quarterly

The Pre-Start

ERA shared that the Federal Court of Australia made an interim order to stay the decision to refuse to renew the Jabiluka Mineral Lease (ERA)

NexGen has expanded the known mineralisation at Patterson Corridor East, with 8 out of 12 holes intersecting mineralisation (NXG)

Piedmont shipped 14kt of spod (via its contracts) from NAL, with recoveries at 68%. It experienced a net loss of US$13.3m for the Q (PLL)

Triple Flag Royalties declared a US$0.55 dividend and is on track for c. 110koz gold equivalent ounces (TFPM.TO)

Perenti, via Barminco, has secured a 3-year underground contract extension with Barrick at Hemlo (PRN)

Cokal is in trading halt pending new info on an underground mining agreement at Bumi Barito (CKA)

A bit of moving and shaking in the last 24 hours:

Aussie Super continue to build their Lynas stake now at 8.5% (LYC)

BUMA has picked up a 5.1% stake of 29Metals (29M)

Cranport became a substantial holder of Sierra Nevada Gold with a 7.3% stake (SNX)

Collins St have built their stake in Tesoro Gold to 11.4% (TSO) and are up to 7.3% in Astron post conversion of convertible notes (ATR)

OD6 Metals appointed Wayne Bramwell as independent non-exec chair of the rare earths explorer (OD6)

High Grade It

ERA secured an 11th-hour legal win just days before the mining permit was set to expire (AFR)

Bad news for Australia: China’s steel crisis is set to deepen (AFR)

China will issue 70 national standards for carbon footprints, energy efficiency & consumption as well as carbon capture & storage (Reuters)

Fortescue says Element Zero’s timelines and funding don’t stack up (The Australian)

Gold Fields signed a native title agreement with the traditional owners of the land the St Ives sits on (West)

IGO has entered into an agreement with ASX minnow Medallion over the potential sale of assets within Forrestania (CB)

Commercial crude oil stockpiles, excluding the Strategic Petroleum Reserve, drop by 3.7m barrels; Analysts predicted a 500k barrel fall (WSJ)

Oil prices edged higher for a 3rd straight session over market anxiety about supply risks due to tensions in the Middle East (Reuters)

Australian dollar climbs after central bank governor warns on inflation (FT)

Government retreats on solar panels as China fires up (The Australian)

Copper prices are back below US$4/lb, but stocks are still pricing in much higher (MI)

Recycler US Strategic Metals has tapped the EX-IM Bank of the US for a loan package worth US$400m with a 15-year term (Mining.com)

Legal fees for the 22-week trial in the class action against BHP over the 2015 Mariana dam disaster in Brazil could top £350m (AFR)

Wheelin’ n Dealin’

Australian Meat Industry Super’s on-market takeover for Dynamic D&B has been declared best and final, who currently hold 35.8% (DDB)

Strandline completed the sale of its Tanzanian mineral sands assets, total consideration of $43m was applied to debt and interest payments (STA)

Street Talk has followed up on word on the decline that Creasy is in talks to buy Macquarie’s $148m debt at Calidus (AFR)

Sierra Rutile shared an overview of its takeover offers since March, with Leonoil providing the board support offer (SRX)

Rattlin’ the Tin

Word on the Decline

We’re hearing Develop is busy looking around at (troubled) base metal operations up ‘n’ down Australia… more than a couple come to mind

Do you have some Word on the Decline? Reply to this email or shoot a message to [email protected] directly. We will always take your privacy seriously.

In the Weeds

The Life and Death of Adolf Lundin (Institutional Investor) A 2006 deep dive into the patriarch of the Lundin family

Is the IRA the behemoth scheme we have all been led to believe? (MiningNews)

Northparkes Mines Promotional Video circa 1997 by North Ltd (YouTube)

Further to our Q&A episode, a Money Miner shared an awesome video on the issues with recycling nuclear waste (DW Planet)

Is Australia still the lucky country? See what our GDP ranking shows (The Australian)

Blaze in South Korea prompts debate over whether EVs should be allowed in the country’s ubiquitous underground parking lots (WSJ)

Private credit funds find $1T target in rich Australians (Bloomberg)

Today’s Top Tweet

My accountant after seeing that I placed 57,987 trades last year just to make $23 in profit

— Not Jerome Powell (@alifarhat79)

12:38 PM • Aug 7, 2024

Devil’s in the Detail

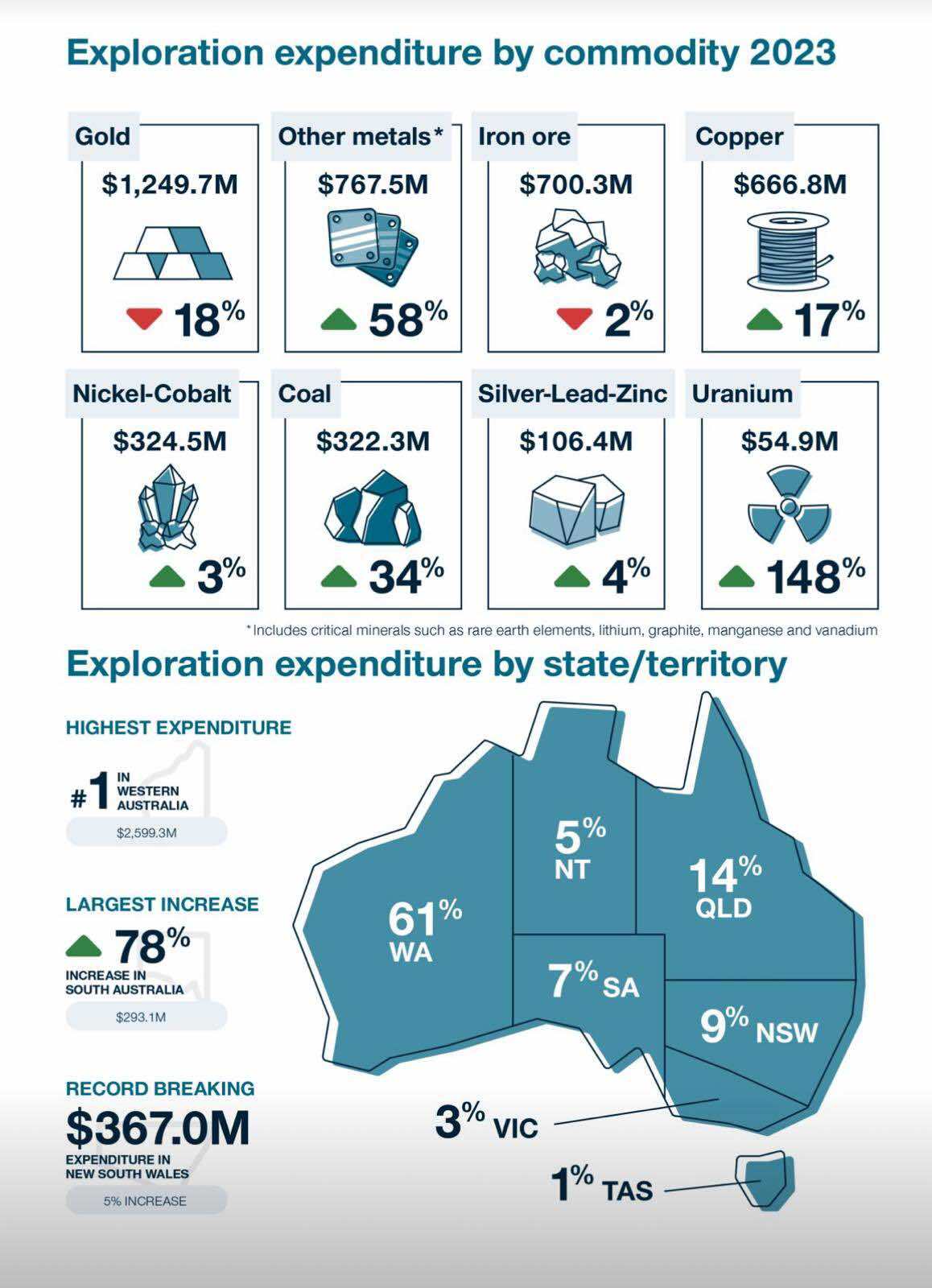

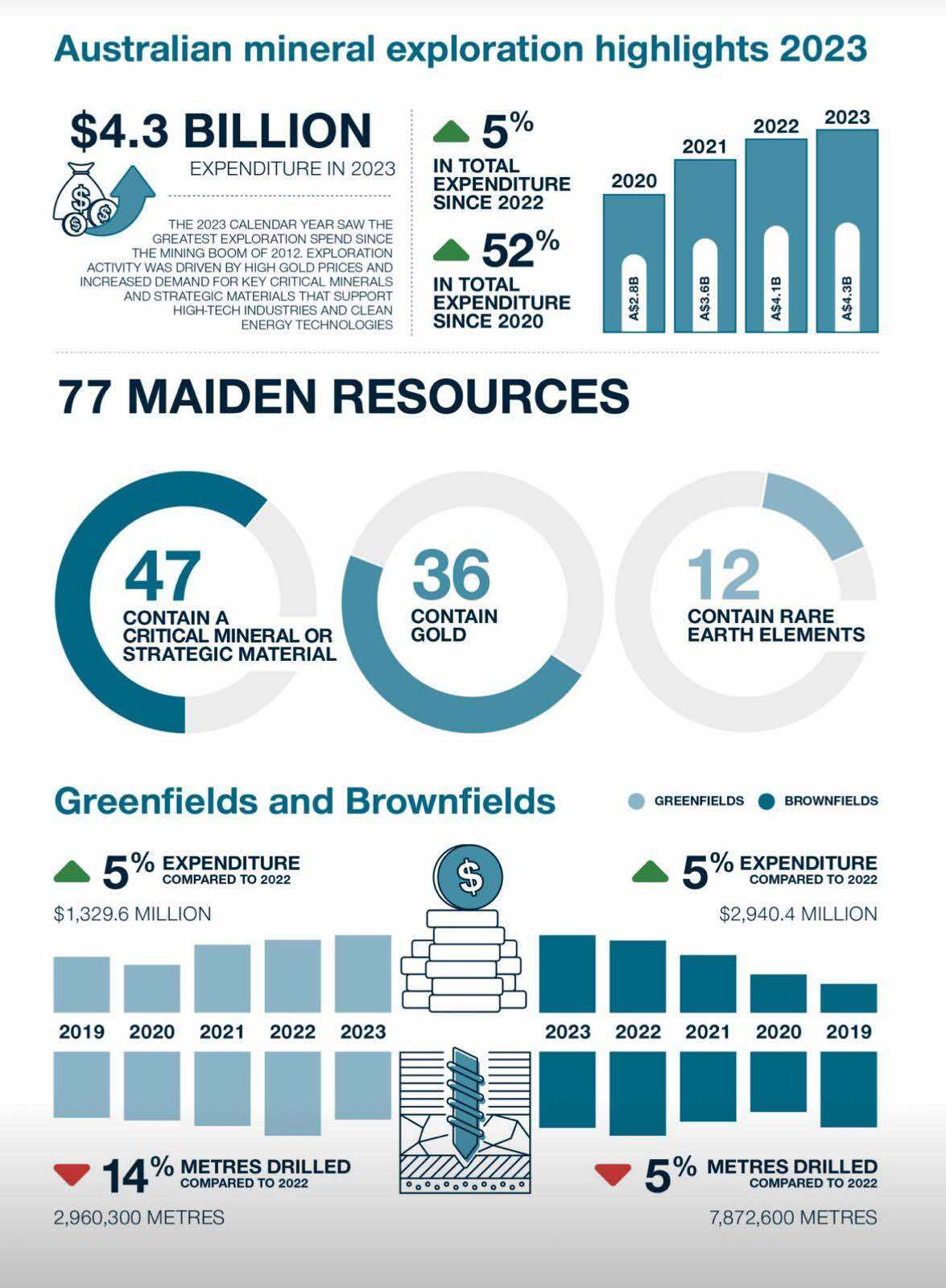

Boy, how these numbers will look different in the 2024 edition!

Catch up on our latest episode

🟢Spotify | 🟣 Apple Podcasts | 🟥 Youtube

Reply