- The Director's Special

- Posts

- China Stimulus Sparks Life into Miners

China Stimulus Sparks Life into Miners

Anglo set date for coal bids + MINs bags $1.1b after haul road sale

The Pre-Start

Fortescue signed a US$2.8b equipment partnership with Liebherr to jointly develop a range of battery-powered gear, lifting the total number of supplied machines to 475 (FMG)

Bannerman updated on Etango progress, with key contracts awarded, plant components ordered and early works underway (BMN)

Core Lithium updated its reserves, growing BP33 to 8.7Mt @ 1.38% Li2O, while reducing Grants to 0.6Mt at 1.40%, while updating the modifying factors meant no reserves were reported at smaller deposits (CXO)

Turaco shared a further 5 drill results from Woulo Woulo, returning extensions to the recently released MRE (TCG)

Santana has progressed its 1-for-3 stock split, with the split coming into effect on November 6 (SMI)

Bowen Coking Coal has requested an extension to its suspension (BCB)

Agrimin announced the resignation of Richard Seville as Chair & Brad Sampson as director (AMN)

Van Eck lifted its Evolution Mining holding to 11.7% (EVN)

Stock buybacks continued at S32 & KAR, while WHC & DLI share annual reports

High Grade It

Commodities pushed higher after China announced a series of major measures to boost growth & shore up its beleaguered property market (Bloomberg)

ASX miners jumped on Tuesday following China's new growth measures (CB)

Over a dozen like-minded nations could fund Australian critical minerals projects after the US & allies vowed to establish a joint finance body (AFR)

Labor has approved three coal mine extensions in Hunter Valley (Australian)

Iron ore prices lifted by >5% as Beijing caves on stimulus (West)

Inflation to hit three-year low, but don’t expect a rate cut: Bullock (AFR)

The RBA kept the cash rate on hold at 4.35% (CB)

China’s Tianqi will keep fighting for a right to have a say in the SQM-Codelco deal (Bloomberg)

The Clean Energy Regulator upgraded its estimate of large-scale wind & solar power capacity likely to come online this year by nearly double (AFR, Australian)

Huayou Cobalt & Tsingshan are defying low lithium prices to develop a deposit with a Zimbabwean state company (Bloomberg)

The Canadian province of Saskatchewan has vowed to compete with China in processing and production of rare earths (Reuters)

Perth-based Viburnum launched a $300m mining industrials fund with new money from family offices (West)

Macquarie has been fined after failing to catch dodgy energy transactions (AFR)

Indonesia's Joko Widodo launched a US$941m smelter-grade alumina refinery run by state-backed Antam & Inalum (Reuters)

Woodside is facing investor dissatisfaction compelling some funds to exit the stock amid concerns over the stability of its dividend (AFR)

Wheelin’ n Dealin’

MinRes announced the completion of 49% of the Onslow haul road to MSIP, with $1.1b received and the $750m bridge facility cancelled (MIN)

Dataroom reported final binding offers for Anglo’s coal assets are due November 11, with Glencore the top contender (Australian)

Denison announced an option agreement with Foremost, granting Foremost an option to acquire up to 70% of 10 uranium properties for up to US$30m (DML.TO)

Takeovers Panel declines to conduct proceedings in relation to ERA entitlement offer. ERA intends to proceed with the entitlement offer ASAP.

Rattlin’ the Tin

Coronado priced its US$400m note offering paying 9.25%, due in 2029 (CRN, Street Talk)

Canadian copper-gold explorer FireFly Metals taps four brokers for $60m raise (Street Talk)

Astral completed a $25m capital raising, deeming itself fully funded to FID (AAR)

Cauldron Energy in trading halt for a capital raise (CXU)

In the Weeds

Here’s a blast from the past - an SMH article following Rio Tinto’s historic (infamous?) A$19b rights issue from mid-2009. The perils of leverage…

US nuclear plants won't power up Big Tech's AI ambitions right away (Reuters Analysis)

Australia must be wary of Beijing’s ears and hands in consumer goods (AFR op-ed)

Meet the Australian shaking up the global diamond industry (SMH) A deep dive into Michael O’Keeffee of Riversdale & Champion Iron

Xi’s Economic Adrenaline Shot Is Only Buying China a Little Time (Bloomberg)

China is expected to miss its growth target

Today’s Top Tweet

I couldn't imagine an auditors life getting any worse but here we are

— Crash (@Noicewon11)

1:59 AM • Sep 24, 2024

Devil’s in the Detail

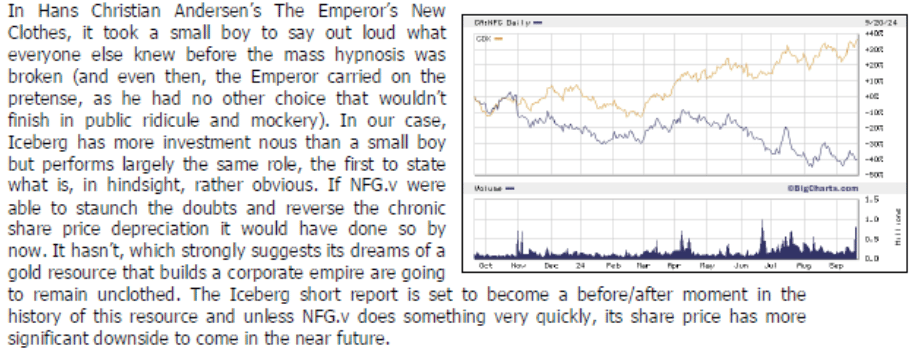

If you’re interested in the New Found Gold short report saga (refer to yesterday’s podcast) here are some concluding comments from a thread on the matter from @Mark_IKN

Catch up on our latest episode

🟢Spotify | 🟣 Apple Podcasts | 🟥 Youtube

Reply